Many types of brick-and-mortar retailers are struggling to remain viable, upended by the proliferation of e-commerce. The retail industry isn’t shedding any jobs as a whole. But different segments of the sector are headed in opposite directions, with jobs tied to online sales and distribution far outpacing the rest of the industry.

One troubling potential consequence of retail’s shift to e-commerce is that many of the newer jobs created typically aren’t spread out very evenly geographically. While brick-and-mortar stores are everywhere, the same can’t be said of distribution facilities and call centers, which are often fairly concentrated. For this reason, how retail's transformation unfolds carries important long-term implications for local economies.

To approximate the effects of the sector’s shift across the country so far, we reviewed county-level job estimates for several types of industries reported in the Labor Department’s Quarterly Census of Employment and Wages. The two industries tracked in federal data considered to best reflect e-commerce-related jobs are "electronic shopping" and warehousing-storage. Over the 10-year period ending in the third quarter of 2017, the two industries created a combined 528,000 jobs, an increase of 59 percent.

Much of this expansion of e-commerce is taking place in relatively few places. Just 31 of the nation’s more than 3,200 counties accounted for half the national growth in the two associated industries over the decade. Only about 14 percent of the U.S. population resides in these 31 counties.

While many of the areas adding the most e-commerce jobs are large urban jurisdictions, several others are exurban and well outside any major population centers. All tend to be in locations favorable for logistics. The following 25 jurisdictions added the highest tallies of jobs in electronic shopping and warehousing over the decade ending in the third quarter of 2017 by our calculations:

| Jurisdiction | Jobs Change | 2007 Q3 Average | 2017 Q3 Average |

|---|---|---|---|

| King County, Wash. | 36,549 | 10,967 | 47,516 |

| San Bernardino County, Calif. | 26,937 | 8,451 | 35,388 |

| Riverside County, Calif. | 20,482 | 7,589 | 28,071 |

| Middlesex County, N.J. | 12,207 | 8,914 | 21,121 |

| Maricopa County, Ariz. | 11,707 | 14,470 | 26,177 |

| Dallas County, Texas | 11,482 | 11,179 | 22,661 |

| San Joaquin County, Calif. | 9,937 | 4,729 | 14,666 |

| Los Angeles County, Calif. | 8,736 | 23,511 | 32,247 |

| Hendricks County, Ind. | 7,650 | 3,489 | 11,074 |

| Tarrant County, Texas | 7,529 | 6,572 | 14,101 |

| Luzerne County, Pa. | 7,343 | 4,651 | 11,994 |

| Baltimore City, Md. | 6,922 | 784 | 7,706 |

| Salt Lake County, Utah | 6,676 | 4,866 | 11,542 |

| Franklin County, Ohio | 6,499 | 18,568 | 25,067 |

| Kenosha County, Wis. | 6,372 | 195 | 6,663 |

| Fulton County, Ga. | 6,401 | 4,829 | 11,230 |

| Mercer County, N.J. | 6,122 | 596 | 6,718 |

| Will County, Ill. | 6,048 | 1,276 | 7,325 |

| Bullitt County, Ky. | 5,846 | 845 | 6,691 |

| Lehigh County, Pa. | 5,649 | 3,639 | 9,288 |

| Northampton County, Pa. | 5,116 | 2,040 | 7,356 |

| Denton County, Texas | 4,896 | 1,214 | 6,109 |

| Lexington County, S.C. | 4,467 | 243 | 4,710 |

| Johnson County, Kansas | 4,446 | 2,025 | 6,471 |

| San Francisco County, Calif. | 4,308 | 3,098 | 7,405 |

It's worth noting that the two industries alone don't capture all e-commerce growth in other parts of the economy, such as delivery services.

Meanwhile, the trajectory of traditional brick-and-mortar jobs is headed in another direction, with the employment base shrinking in most localities. Over the decade, approximately 61 percent of counties reporting data experienced declines in total retail jobs when segments of the industry less affected by e-commerce -- food stores, gas stations, vehicle and parts dealers and nonstore retailers -- are excluded. The majority of counties similarly sustained net losses in overall retail employment across the board.

| Industries | Counties Reporting Data | Counties Losing Jobs | Share of Counties Losing Jobs | Median Jobs Change |

|---|---|---|---|---|

| Electronic Shopping & Warehousing (1) | 608 | 195 | 32.1% | 33.3% |

| Retail Affected by E-Commerce (2) | 1,194 | 731 | 61.2% | -3.8% |

| Retail Affected by E-Commerce (3) | 3,114 | 1,877 | 60.3% | -4.5% |

| All Retail Sector | 3,114 | 1,745 | 56.0% | -1.9% |

- Includes counties with reported data for at least one of the two industries for both years.

- Represents changes in total retail employment, excluding food stores, gas stations, vehicle and parts dealers and nonstore retailers. Only counties with reported data for all five industry classifications are included.

- Represents changes in total retail employment, excluding food stores, gas stations, vehicle and parts dealers and nonstore retailers when reported. Includes all counties, except for those without reported retail job totals.

Still, there are many places where brick-and-mortar retail remains strong. Fast-growing regions where Americans are migrating to or those with booming economies experienced particularly sizable gains. Orange County, Fla., added nearly 12,400 such jobs (+28 percent), more than any other county nationally over the decade.

Retail and E-commerce Jobs Data for U.S. Counties

Make a selection to view retail employment by county and changes in jobs over the 10-year period ending in the third quarter of 2017.Employment Trends by Retail Industry

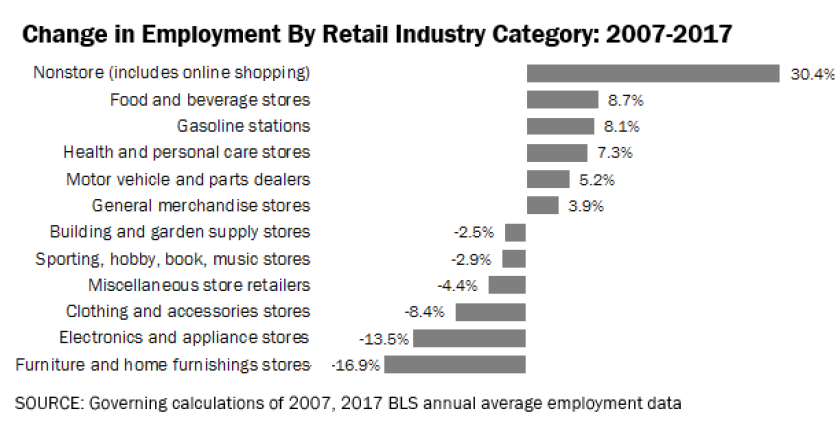

As a whole, retail employment climbed slightly over the decade. Grocery stores, gas stations and other segments of retail with less of an online presence rebounded from losses sustained during the recession. But other types of employers recorded significant declines. Clothing stores, for instance, cut 126,000 jobs over the ten-year period while electronics and appliance stores lost about 79,000 jobs nationally.

Methodology and Data Notes

The Labor Department’s Quarterly Census of Employment and Wages (QCEW) reports industry-level employment data for U.S. counties. Counties’ quarterly private sector job totals were computed by calculating three-month QCEW averages for both Q3 2007 and Q3 2017. The two quarterly averages were then compared over the decade for the following NAICS industries: Retail trade (44-45), electronic shopping and mail-order houses (4541), warehousing and storage (493), nonstore retailers (454), gasoline stations (447), food and beverage stores (445) and motor vehicle and parts dealers (441). E-commerce jobs were considered to be those classified in the electronic shopping or warehousing industries. Companies often classify their establishments inconsistently, with some fulfillment centers classified as electronic shopping and similar facilities classified as warehousing.Some counties lack quarterly employment data for one or more industries as BLS does not publish local data if no jobs are reported or if necessary to protect employers’ confidentiality when there are only a few establishments for an industry. Industries without reported job totals for both quarters were excluded from our calculations. Warehousing and storage, not classified as a segment of the retail industry by BLS, includes companies not associated with online shopping and e-commerce. It’s unlikely, however, that these other employers account for a large portion of the job growth measured over the decade. Other smaller industry classifications not included are also associated with e-commerce, but data aren’t reported in a way that can be parsed out.