Due largely to massive unfunded liabilities for public-employee pensions, the fiscal health of these four states doesn't look promising. If you live there now, you may want to plan on moving to better enjoy your golden years.

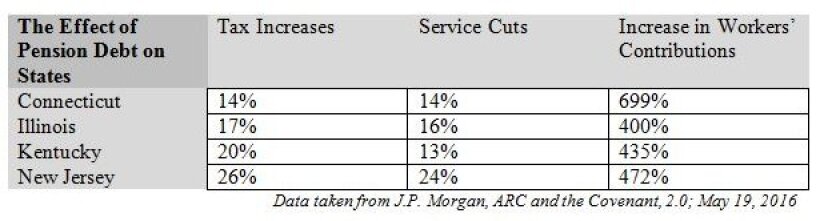

In its report, "The ARC and the Covenants," J.P. Morgan calculated what all 50 U.S states currently spend on bonds, pensions and obligations related to underfunded pensions and retiree health benefits, along with what they would be spending to cover those obligations over 30 years assuming a 6 percent rate of return on investments. Here's what the report's authors found:

• To fully cover its retirement and other debt obligations, Connecticut would have to either increase taxes by 14 percent, cut spending on government services (such as senior health insurance assistance, roads and community centers) by 14 percent, or raise workers' pension contributions by an astonishing 699 percent.

• In Illinois, policymakers would need to either hike taxes 17 percent, cut spending by 16 percent or increase worker contributions by 400 percent.

• Kentucky fares even worse. To pay its retirement obligations, the Bluegrass State would have to raise taxes by 20 percent, cut spending by 13 percent or raise worker contributions by 435 percent.

• But when it comes to taxpayers bearing the brunt of unfunded pension liabilities, those in New Jersey would get hammered the worst. To pay for its massive debt, the state would need to raise taxes 26 percent, cut spending by 24 percent or increase workers' contributions by 471 percent.

PricewaterhouseCoopers (PwC) approaches the problem from a different perspective. In its State Financial Position Index, PwC considers unfunded retirement obligations and aggregated financial assets less liabilities relative to the number of taxpayers and median household income for each state. The four worst states: again, Connecticut, Illinois, Kentucky and New Jersey.

Interestingly, the PwC report notes that the states with the greatest need to improve their relative financial position are experiencing negative net migration. In other words, people are voting with their feet, which of course will make the tax burden even greater on those who stay behind.

And a new study for the Mercatus Center at George Mason University, "Ranking the States by Fiscal Condition," examines states' financial health based on short- and long-term debt and other obligations, such as unfunded pensions and retiree healthcare benefits.

According to the study's authors, "Growing long-term obligations for pensions and healthcare benefits continue to strain the finances of state governments, highlighting the fact that state policymakers must be vigilant to consider both the short-term and the long-term consequences of their decisions." Those states most affected, largely due to the low amounts of cash they have on hand and their large debt obligations, are … Connecticut, Illinois, Kentucky and New Jersey, plus Massachusetts. It plays like a broken a record.

In all, U.S. public retirement programs are more than $1 trillion in debt, resulting in tremendous budget challenges for states and local governments. While it's easy to kick the can down the road for another day, if policymakers don't get control of the pension crisis now, taxpayers and public workers will be paying for it dearly instead of enjoying what should be the best years of their lives.