Back when he was pondering a presidential run, Snyder used a 501(c)(4) as a de facto exploratory campaign committee. More recently, his 501(c)(4) gave out $1,000 checks to more than a dozen legislative allies who looked potentially vulnerable. He used another group like this to pay for public relations help amidst the Flint water crisis.

All of these Snyder creations have one thing in common. They don’t disclose the names of their contributors. Legally, they don’t have to. (Snyder’s office, like those of other governors, declined to comment for this article.)

Electoral politics has been all but overrun in the past couple of years by 501(c)(4)s and other vehicles that enfeeble the idea of contribution limits and free up outside groups to influence the course of campaigns with virtual anonymity. Now they are being used heavily between election years as well. Incumbent officeholders are finding that 501(c)(4)s, inelegantly named after a section of the tax code, are excellent ways to advance their personal agendas. They may not meet the definition of slush funds, but some of them come close.

Most of these nonprofit groups set up by elected officials outside the election process operate under an entirely different set of rules from those that apply during a campaign. They officially list themselves as social welfare organizations, and most 501(c)(4)s indeed used to be charities set up to advance a specific mission of public benefit -- the Sierra Club promoting environmental policies, for instance.

But it turns out that the definition of social welfare can be stretched by these groups to serve purely political purposes. The only formal requirement is that political activity not make up the majority of their work. But that rule is almost never enforced. The IRS not only doesn’t ask 501(c)(4)s for the identities of their contributors, but it also isn’t curious about what the groups are up to. That’s why the media has dubbed such operations as “dark money.”

Michigan Gov. Rick Snyder (David Kidd)

It’s almost de rigueur in many states now for governors taking office to set up 501(c)(4)s to help defray inaugural expenses. Then they go on to use the groups to raise serious dollars to promote their goals through television and digital advertising, lobbying and donations to other politicians. “They are increasingly being used to support policy agendas and keep them on the table,” says Susan MacManus, a political scientist at the University of South Florida in Tampa. “It’s a way of showing the legislature that you have a lot of influence over an issue.”

In an era of permanent campaigning, the task of raising millions never ends. Over the course of a single week this summer, Turnaround Illinois, which is associated with and partially funded by Gov. Bruce Rauner, spent more than $1 million on ads promoting the idea of legislative term limits. Two governors -- Charlie Baker of Massachusetts and Nathan Deal of Georgia -- have allied groups as partners promoting their education initiatives on ballots this fall. None of these governors is on the ballot next month.

There’s certainly nothing new about friends of a governor -- or aspiring friends of a governor -- helping to promote his causes. But it’s new for governors themselves to be setting up campaign-type organizations that collect and disburse large amounts of funds to further their own priorities. “We have elected officeholders very closely involved with outside groups that can raise and spend unlimited amounts of money to promote their agendas,” says Chisun Lee, a senior counsel at the Brennan Center for Justice at New York University.

In a way, it’s a relatively risk-free move for donors. Rather than supporting a candidate who may or may not be elected, they can devote their money to helping someone who is already in office. And the majority of these groups are indeed dark money operations: Only a few states impose their own disclosure requirements. Putting regulations in place -- assuming there’s interest in doing so among the political class -- could be even trickier than crafting workable campaign finance regulations. The lines get blurrier and issue advocacy enjoys strong and explicit protection under the First Amendment.

But secret money and politicians make for a combustible mix. The key question is how expansive these groups can be while staying within the bounds of the law. The answer, so far, is: very expansive. To the extent that the public has reservations about unlimited contributions to political campaigns, there are good reasons to be concerned about unlimited contributions to groups pushing a governor’s agenda. “This is a frontier,” says Robert Maguire, political nonprofit investigator at the Center for Responsive Politics, which tracks campaign finance. “This is going to be a very attractive avenue for any interests in the state that have business before these politicians, but want to keep their spending out of the eyes of the public or the people they’re trying to influence.”

The 501(c)(4)s occupy a sweet spot. Purely charitable organizations, known as 501(c)(3)s, don’t have to disclose their donors, but they are severely restricted in terms of lobbying and political activity. Political action committees can do pretty much whatever they want in the political realm, but they have to disclose donors. The beauty of 501(c)(4)s is that they allow people and corporations to have an impact on politics and policy and to do it anonymously.

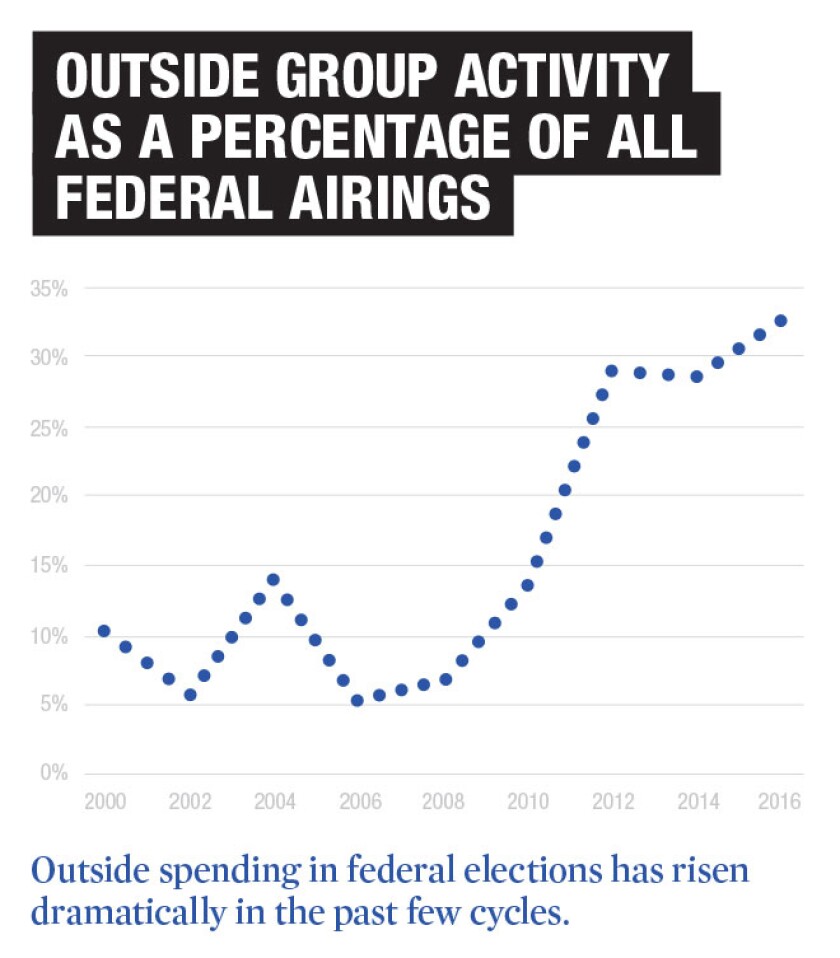

Their influence over elections is clear. The full amount spent this year by 501(c)(4)s won’t be known for months after the voting, but “a lot” is certainly a fair estimate. Back in 2006, these groups spent about $5 million on election campaigns. By 2012, they were spending more than $300 million. Political donations by outside groups have not only grown dramatically over the past decade but have also become far less transparent.

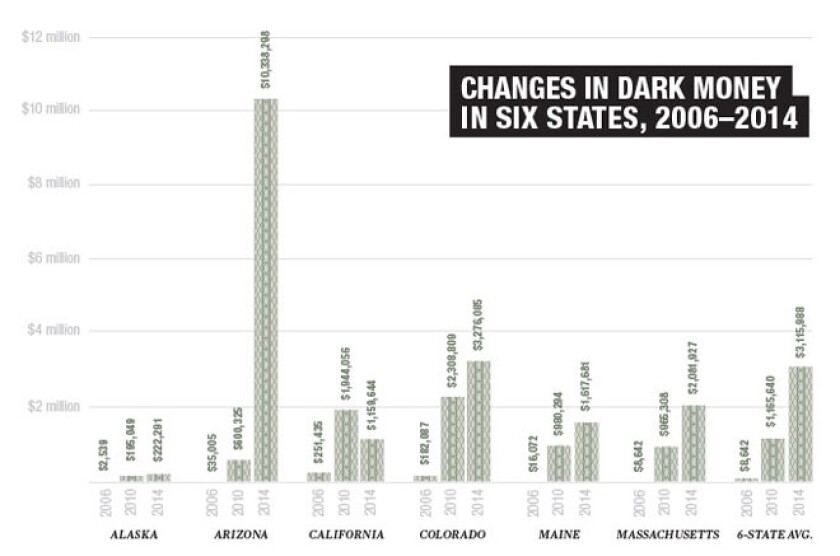

In state elections in 2014, according to a recent Brennan Center study, only 29 percent of political spending from outside groups was still being done by organizations legally required to disclose their donors. That was a precipitous drop from nearly three-quarters of such spending being out in the open back in 2006. Looking at six states, the study found that dark money spending increased on average by a factor of 38 over eight years. In Maine, the amount rose from a mere $16,000 in 2006 to $1.6 million in 2014. In Arizona, the equivalent jump was from $600,000 to $10.3 million. By late summer, three out of every four ads sponsored by outside groups for the 2016 campaigns were paid for with dark money, according to the Center for Responsive Politics.

In the Citizens United era of virtually unlimited political spending, donors are used to throwing large amounts at campaigns. There’s an outside group for everything. There’s an advocacy group devoted to electing Republican agriculture commissioners. Through a political action committee known as Safety & Justice, liberal billionaire George Soros has put hundreds of thousands of dollars over the past year into district attorney contests in Florida, Louisiana, Mississippi and New Mexico, among other states.

Once it became so simple to raise and spend money in elections, it was only a small additional step to use the same tools in the policymaking arena. The idea got its first big tryout with Organizing for America, a nonprofit group that spun out of President Obama’s campaign arm and helped push his legislative goals early in his first term. That attracted the attention of ambitious governors. “A 501(c)(4) can spend 100 percent of its money advocating,” Maguire says. “There are no limitations, like there are when they’re engaging in elections.”

The ability of a governor -- or technically speaking, a 501(c)(4) associated with the governor -- to throw around money lends weight to his promises and his threats. Turnaround Illinois and its “unfettered amounts of dough” have helped turn the legislature into a more partisan place, complains state Rep. Jack Franks. “The money, it’s very intimidating to many folks,” he says. “It doesn’t allow for any compromise because if you’re in the center and compromising, you become a target.”

Like several other big-state governors these days, Rauner is a millionaire many times over. He and other rich governors such as Tom Wolf of Pennsylvania have put substantial amounts of money into 501(c)(4)s themselves. But they can still raise money from other interests. For less wealthy governors, raising outside money is usually the only option. In some cases, the governor has a clear and close relationship with allied 501(c)(4)s. Tom Willis, a top aide to Deal in Georgia, left Deal’s staff to run a 501(c)(4) called Georgia Leads, which is supporting a ballot measure favored by the governor next month to allow the state to take over failing public schools. The group has taken in five-figure checks from beer distributors, AT&T and the Hospital Corporation of America, among others, according to The Atlanta Journal-Constitution.

In some instances, 501(c)(4)s operate at arm’s length from the governor, or at least keep enough distance to allow him to maintain plausible deniability. Early in his term, college friends of New Jersey Gov. Chris Christie set up a group called Committee for Our Children’s Future, which spent $5 million burnishing his image and pushing his proposals. “If they are out there helping me, I say thank you very much,” Christie said during a news conference in 2011. “But I have nothing to do with the group. I don’t raise money for them.”

In Massachusetts, Gov. Baker does not have direct control over groups that are currently pushing a measure on the November ballot to expand charter schools, but they are clearly following a course that he has set. “It’s hard to say that any of these 501(c)(4)s are Baker-operated, but two of his top operatives are very involved in running the pro-charter school campaign,” says Maurice Cunningham, a political scientist at the University of Massachusetts Boston. “All of it, every last penny, is dark money.”

Governors know it looks bad if their rich friends or big companies are seen giving them or allied groups large checks, or if they appear to be hiding substantial donations. That’s why so many of them find dark money groups appealing. Sometimes, they use a “unilateral disarmament” defense. They say that deep-pocketed political foes are using 501(c)(4)s to spend heavily against their ideas, so they need to deploy outside groups as a countervailing force. “People are starting to understand that 501(c)(4)s are a mechanism that can actually educate constituents,” says Rick Thompson, a former Georgia ethics commission director who has worked as a consultant to Deal. “Educating the constituency does not mean that they support you.”

If governors, with all their power and their command of the bully pulpit, need separate multimillion-dollar organizations to get their messages out, that threatens to raise the price of admission for everybody. In August, The Birmingham News reported that current and former officials in the University of Alabama system were running a dark money nonprofit. The university system is barred from making political donations, but it had used the group to funnel more than $1.4 million into the political process. That figure included $541,000 directed to a political action committee.

The University of Alabama’s nonprofit is a 501(c)(6), a status meant to be used by professional associations and business leagues such as chambers of commerce. Over the past few years, the university has separately paid some $245,000 to a marketing company owned by Jon Mason. Mason’s wife, Rebekah, has been identified publicly as the mistress of Gov. Robert Bentley.

Last year, a 501(c)(4) called the Alabama Council for Excellent Government, or ACEGOV, was founded to “advance the agenda of Gov. Robert Bentley,” with two of his aides listed as incorporators. “The purpose of the nonprofit is for us to be able to get our message out somewhat unfiltered,” Bentley said. In March, Rebekah Mason revealed that ACEGOV had paid her $15,000 in 2015 for consulting services.

“We’ve seen this with a lot of super PACs and other political organizations,” says Lee Drutman, the author of The Business of America Is Lobbying. “They actually end up being ways for consultants and organizers to get very rich, raising a lot of money to pay themselves.”

When he was recorded talking about the possibility of selling the appointment to Obama’s vacant Senate seat after the 2008 election, Illinois Gov. Rod Blagojevich floated the possibility of getting the new president’s allies to kick in $10 million or $15 million toward a 501(c)(4), “so I can advocate health care and other issues I care about and help them, while I stay as governor.” He said it would also give him a place to go when he was “no longer governor.”

SOURCE: Kantar Media/CMAG with analysis by the Wesleyan Media Project. 2016 figures are through 8/1/16 only.

It’s clear that contributions to a nonprofit associated with a particular politician can present the potential for corruption. But from a policy standpoint, the bigger issue is whether 501(c)(4)s distort the regulatory and lawmaking process. Rather than personal enrichment, the concern is usually that donors with business before the government might receive a more favorable audience because they have written six- or seven-figure checks to an official’s advocacy group. Politically interested parties are spending millions of dollars pushing particular policies, and most of the time the public has no way of finding out the source of those dollars. “That, in a democracy, is unacceptable,” says Cunningham, the Massachusetts professor.

If the secrecy involved with 501(c)(4)s does lead to a backlash, disclosure requirements will have to come from the states. The IRS has made clear it will not change its policy and begin challenging such groups, even if they have pledged not to engage in significant political activity and then do exactly that. “If this does become the norm at the state level, it’s going to become a lot harder to do anything about it,” says Maguire of the Center for Responsive Politics. “There’s very little that will ever happen to such groups in terms of oversight and discipline.”

Legislative attempts to regulate 501(c)(4)s have generally been left on the cutting room floor. New York this summer became an exception. As part of an ethics package enacted at the end of the legislative session in June, 501(c)(4)s that spend at least $10,000 per year on issue advocacy have to file reports with the state attorney general -- reports that must reveal the identities of donors who give $1,000 or more. “We are strengthening disclosure requirements so we know exactly where and from whom this dark money flows,” Gov. Andrew Cuomo said.

He should know how important that is. Before it was disbanded, a Cuomo-aligned 501(c)(4) called the Committee to Save New York raised some $17 million. In its heyday, it ran numerous TV ads touting the governor’s agenda and was the biggest lobbying spender in Albany.

*This story appears in the October 2016 issue of the print magazine.