In a report published Monday, the National Association of Counties (NACo) analyzed economic data for counties to gauge how well they’ve recovered. The analysis considered four measures: job totals, unemployment rates, economic output (GDP) and median home prices. Overall, the findings depicted an uneven recovery.

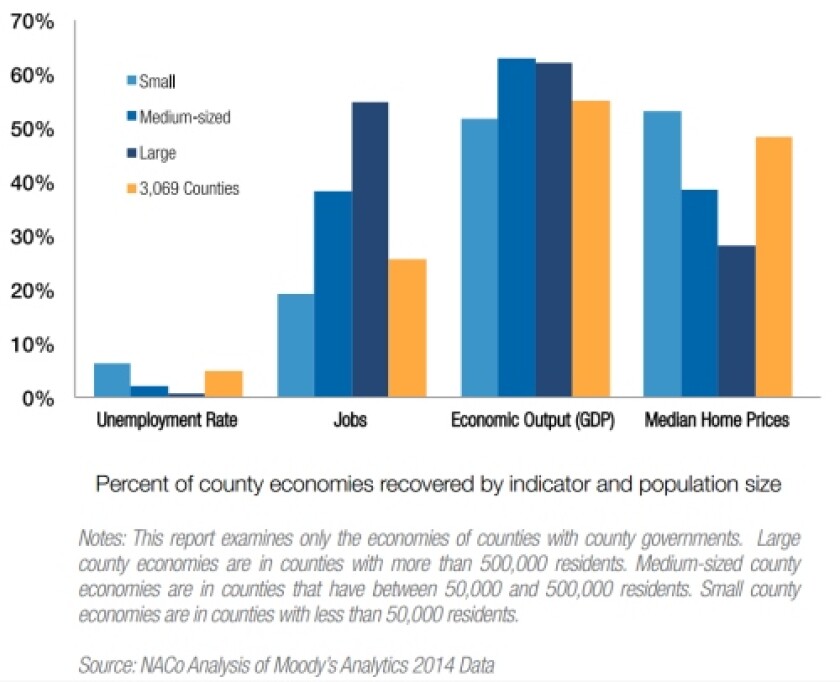

Only 65 counties (out of more than 3,000 nationally) have seen all four economic measures fully recover from pre-recession peaks. Nearly three-quarters of counties remain below their pre-recession employment levels, while economic output hasn’t recovered in 45 percent of counties.

“The national numbers mask the reality on the ground,” said Emilia Istrate, NACo’s research director. “It explains why Americans do not feel the good economic measures.”

Many of the economies least affected by the Great Recession are concentrated in Great Plains states. Regions with the strongest economies in recent years benefited largely from growth in the energy sector, particularly in North Dakota and Texas.

The report notes that it’s the larger county economies (counties with more than 500,000 residents) that are generating a disproportionate share of new jobs. Many of these jobs, however, are found in low-wage sectors. Between 2012 and 2013, average wages grew in just 37 percent of large counties after adjusting for inflation and cost of living, according to the report.

The extent to which counties recovered depends in large part on the industries making up local economies. Rural counties and those with fewer residents are typically tied to agriculture. The bulk of manufacturing jobs, meanwhile, are found in mid-sized counties (those with between 50,000 and 500,000 residents). Most of the 65 local economies that fully recovered on all four measures reviewed were those of smaller counties.

The following chart from NACo’s research breaks down the recovery by county population size:

Overall, the report shows a recovery that's much bleaker than the national outlook reported in recent months. One reason for this is that the analysis compares annual figures, while some of the stronger economic gains (such as GDP growth) didn’t register until late last year. NACo also determined the pre-recession peak for each individual county for its calculations, better characterizing how local economies have fared since they don’t all follow the national cycle.

Local economies represent a significant source of revenues for county governments. Those lagging behind in the recovery are more likely to encounter difficulties in maintaining services and meeting financial obligations. This, in turn, carries larger ramifications.

“Counties economies are building blocks of regional, state and national economies,” Istrate said.

See NACo's interactive map for data for each county.