In fact, the plan has been in a virtual freefall for years. At the end of the 2013 fiscal year, the plan had $3.3 billion in net assets -- that's roughly half of its peak value just before the Great Recession. The gap makes it the pension system that has the farthest to go to recover the assets it lost in the stock market crash, according to a Governing analysis of 146 larger pension plans across the country.

It’s not for lack of performance -- Kentucky has had some big returns in recent years. This summer, it reported a 15.5 percent rate of return on the fiscal year that ended June 30. The year before that, it earned a 12.7 percent return on investments. But for all that great performance, Kentucky Retirement Systems has continued to bleed money. It now has just one quarter of the assets it needs to cover its more than $12 billion in estimated liabilities and its dependents worry it will run out of money in the next decade.

“We are not going to invest our way out of this,” Carroll said.

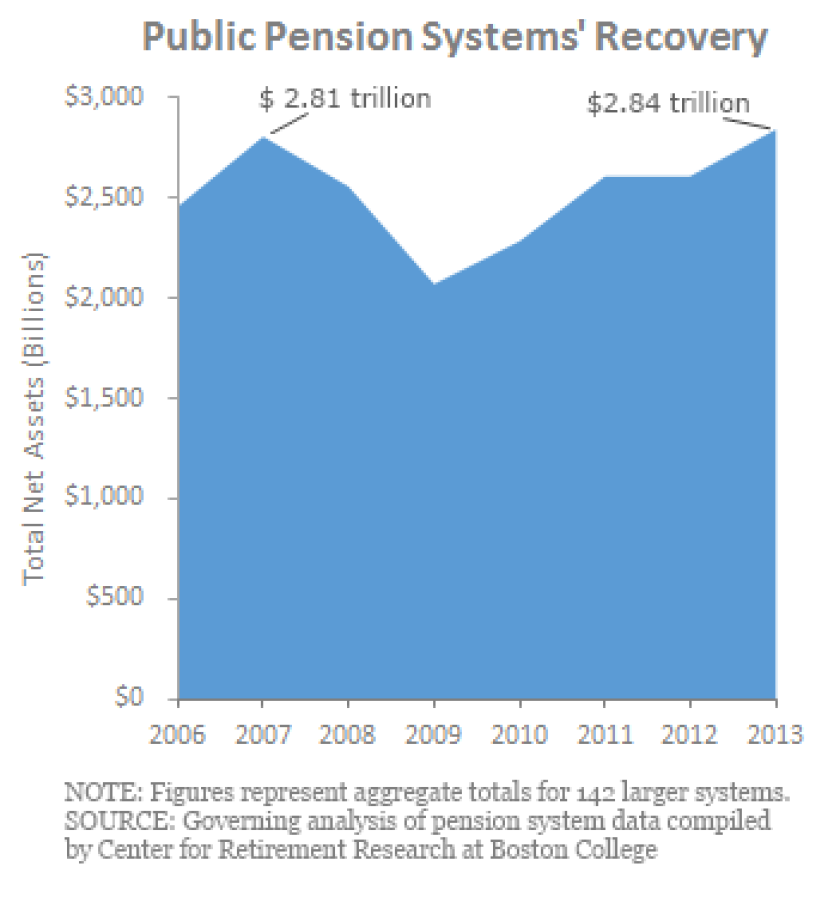

Kentucky is not alone. Overall, 57 pension systems (39 percent) have not recovered their assets prior to the recession and 18 of those plans are still more than 10 percent below their peaks. Meanwhile, 89 systems have now regained their losses. Most plans’ peak year was 2007, followed by losses the following two years that added up to a one-quarter drop in average value across the plans.

Collectively, the asset values of the 146 systems has recovered from the recession and now total $2.84 trillion, up about 1 percent from 2007. This value, however, does not account for inflation. If adjusted, the aggregate total would not yet have recovered from the recession’s losses.

The recovery level of plans, however, is varied. Some have surpassed their pre-recession peaks by more than 50 percent. On the other end, Kentucky’s state employee plan has the farthest to go, followed by other pension funds that commonly make headlines. Those are: Chicago’s police, city and teachers’ funds, Pennsylvania state and teachers plans and New Jersey Teachers’ plan -- all which are more or less one-quarter short of their pre-recession peaks.

| System | Change in Net Assets | 2013 Net Assets | Pre-Recession Peak (2007) |

|---|---|---|---|

| Kentucky ERS | -47.9% | $3,275,345,000 | $6,283,932,000 |

| Pennsylvania School Employees | -27.2% | $49,015,561,000 | $67,340,997,000 |

| Chicago Police Annuity Benefit Fund | -24.6% | $3,265,200,554 | $4,333,233,927 |

| New Jersey Teachers | -24.5% | $26,059,372,740 | $34,526,663,130 |

| Chicago Teachers | -24.3% | $9,674,188,563 | $12,772,609,250 |

| Pennsylvania State ERS | -22.9% | $27,394,156,000 | $35,516,198,000 |

| Chicago Municipal Employees Annuity Benefit Fund | -22.7% | $5,421,676,295 | $7,010,007,533 |

Among these plans, underfunding is a recurring theme. All of the plans in the chart above were not being fully funded by their governments when the recession hit and they continued to be underfunded through the market recovery period. This meant that these pension plans were unable to fully capitalize on the big gains of the stock market in recent years. Meanwhile, noted CRR Assistant Director of State and Local Research Jean-Pierre Aubry, it’s not as if liabilities stood still since the recession. “For the plan to improve its funded ratio, its assets have to grow faster than its liabilities, he said. “So when you’ve had the losses we’ve had in 2008 and 2009, they really need to have monumental gains to improve their funded ratio. If you already have huge numbers in liabilities, you can’t just be plodding along if you want to make up that ground.”

That also means that even plans that have been well funded by their governments have generally not been able to catch up to their funded status before the recession. They do, however, tend to be far healthier than the plans that have not caught up.

Texas’ county and district pension plan, for example, was almost fully funded in 2007 when its assets suffered a 29 percent drop the next year. The contributing governments kept funding the plan, making slightly more than the recommended contribution each year. By 2010, the plan had recovered its losses. By 2013, the plan’s net assets were 37 percent higher than in 2007. Yet its funded status was 88 percent -- healthy by actuarial standards, which indicate plans should be at least 80 percent funded. But as the plan’s liabilities grew, thanks to more employees retiring and living longer, the gains were not enough to get back to the 94 percent funded status it enjoyed before the recession.

Meanwhile, plans that don’t have a history of consistent funding from their governments went from marginally healthy to ailing in a matter of years. Kentucky’s state employee plan was actually overfunded in 2002, with 110 percent of the assets needed to cover liabilities. Since then, its actuarial liabilities have doubled while its assets have been more than cut in half. Over that same period of time, Kentucky has not made its full actuarial contribution. Even before the recession, Kentucky’s funded status had taken a hit -- in 2007, it was 58 percent funded. As it continued to lose money post-recession, its funded status slid further to 25 percent.

Another example: New Jersey had not been putting any money into its state teachers' plan since at least 2001 (as far back as the CRR data goes) because at the time, the system was fully funded. But even when it dipped below fully funded after 2003, it took a few years for the state to start making any contributions at all. And those contributions have been a small fraction of the amount the state should be paying. (In fact, last week, the state’s three largest pension funds sued Gov. Chris Christie for cutting $2.4 billion in pension fund payments he promised to pay as part of 2011 pension reform.) New Jersey's teachers plan in 2007 had 75 percent of the assets it needed to cover promised payments to retirees; as of 2013, it had just 57 percent.

So, while a plan’s investment recovery is not the only factor in its overall health, it plays a substantial role. Plans that have recovered their investment losses tend to be healthier than plans that have not. Just about everybody lost out when the stock market crashed. But the cut went a lot deeper for the pension plans that weren’t getting enough money from their governments in the first place. In fact, three of these seven highlighted plans were healthy by actuarial standards before the recession. Today, none of them are.

“It illustrates the peril of becoming severely underfunded,” said Keith Brainard, research director for the National Association of State Retirement Administrators. “Being severely underfunded combined with a strong market decline can really create fiscal distress for employers.”

In Kentucky, that severity is reaching a breaking point. Since 2011, the plan has lost an average of $260 million per year while its payouts to retirees have averaged about $900 million per year. The state passed pension reform in 2013 that will effectively end cost of living pay increases to retirees. The reform also included a requirement that the state fully fund the plan, and for 2014, it has made its full actuarial contribution. But the retirees association’s Carroll worries that won’t be enough. He asserted that the state must also make up for at least some of its missed payments over the last decade.

“This deep hole has been dug with a shovel and it's being filled using a hand trowel," he said. "In several years I have to hope the situation will ease and I have to hope the stock market doesn't decline during that time.”

Data Editor Mike Maciag contributed to this story.

Retirement System Data

Learn About Tableau

SOURCE:Governing calculations of data compiled by the Center for Retirement Research