It’s likely that those characterized by commercial innovation will be crucial to the economy in the coming years. A Brookings Institution report released today identifies these select sectors -- known as advanced industries -- that it says will help sustain regions’ future economic well-being.

While some areas have sizable numbers of these “crown jewel” industry jobs, they’re largely absent in many other regional economies.

“These are the industries that are prerequisites for anchoring truly vibrant and broadly-shared prosperity,” said Mark Muro of Brookings’ Metropolitan Policy Program. “It’s clearly a difficult road ahead for places that have very little presence in these industries.”

Brookings identified 50 advanced industries spanning the manufacturing, energy and services sectors. Those industries considered to be "advanced" in the report invest heavily in research and development while also employing a large share (at least 21 percent of the workforce) of employees with STEM (science, technology, engineering and math) skills. Such occupations include aerospace manufacturing, computer systems design and electrical power generation.

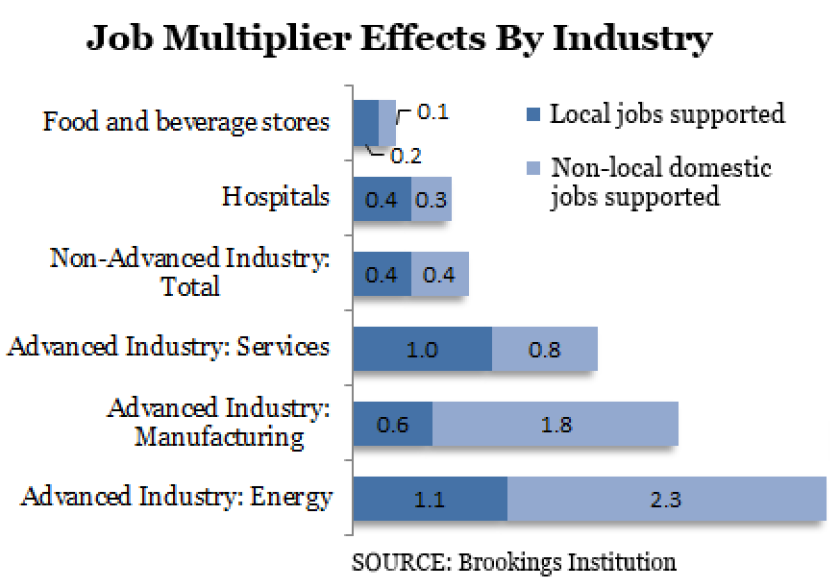

Nationwide, advanced industries account for about 12.3 million workers. While that’s only about 9 percent of total employment, the industries produce 17 percent of U.S. gross domestic product.

Traditional industry classifications are based solely on types of products produced. The Brookings study instead focuses on shared industry inputs, particularly tech skills and research investment. This updated approach to industry analysis, the authors write, better reflects the greater complexity and interconnectedness of contemporary production processes.

Most of the country’s advanced industry jobs are concentrated in the nation’s largest metro areas. Brookings found that they’re most prevalent in San Jose, accounting for about 30 percent of total employment -- far higher than any other metro area studied. Technology hubs, like Seattle and Austin, also have higher concentrations of these coveted jobs. There were also a few surprises, like Detroit. The metro area employs an estimated 279,000 advanced industry workers, the fourth highest tally nationally when measured as a share of total employment.

Large research universities boost many of the top-performing metro areas. Muro noted that these regions also benefit from scientists and deep STEM workforces.

Most regions’ presence of advanced industries is relatively small, however. One cause for concern is that the number of metro areas benefiting from these skilled occupations is shrinking. In 1980, advanced industries made up at least 10 percent of the workforce in 59 of the 100 largest metro areas. Brookings found that, by 2013, this figure had dropped to just 23 metro areas.

“There’s a sense that a group of places is pulling away somewhat from the others,” Muro said.

Four metro areas reviewed have shed more than half their advanced industry workers since 1980: Rochester, N.Y., Scranton, Pa., Springfield, Mass., and Youngstown, Ohio. By comparison, the Atlanta, Austin and Washington, D.C., metro areas all saw employment more than double. (See an interactive map showing changes in employment for each metro area.)

If the sector’s recent performance is any indication, advanced industries will likely be key to the growth of regional economies in the years to come. The report notes that the 50 identified industries collectively added nearly one million jobs since 2010, a growth rate about 1.9 times greater than the rest of the U.S. economy.

Each worker in the sector generates $210,000 worth of output, compared to $101,000 for those in other industries, the study noted. They’re also paid well, accordingly. Advanced industry workers earn nearly double that of the average worker and have enjoyed steady pay raises, while wages for other segments of the economy remain flat.

Select industries typically form clusters in a region, enabling companies to leverage supply networks and hire employees with needed skills. The Wichita metro area, for example, specializes in aerospace manufacturing. Bakersfield, Calif., and Oklahoma City focus more on segments of the energy sector. Brookings’ Muro said policymakers must be aware of their strengths and help those sectors build a “critical mass.” At the same time, though, investing in only one area remains risky.

The report calls for additional investment in research and development, along with forging partnerships supporting local advanced industry ecosystems. The public sector can also further develop industry-specific skills pipelines to ensure that employers have access to a well-trained workforce. Two programs highlighted in the report were Colorado’s Advanced Industries Accelerator Programs and the Commonwealth Center for Advanced Manufacturing in Virginia.