“Because of all the attention paid to the problems in pension plans,” says Wendell Potter, a former health insurance executive who has dealt extensively with insurance in the public sector, “this issue hasn’t gotten nearly as much attention as it deserves. Yet it’s very, very important.”

The backstory here won’t surprise anyone. When health-care costs go up -- as they have for years --insurance rates go up. States are left facing higher bills, but they don’t want to raise revenue or cut spending to pay for them. Result? The states pass a larger and larger portion of the tab on to their employees.

Consider New Jersey. In 2011, the state dramatically changed the way employee premium costs were calculated, moving from a system in which an average employee paid 3.6 percent of premium cost, according to NJ Spotlight, to a sliding scale based on salary. Employees now pay anywhere from 3 percent of their premiums for family coverage (for employees who make less than $25,000 in salary) to a whopping 35 percent (for employees who make over $110,000).

Another example comes from Delaware. Beginning in July 2016, the state upped employees’ share of their premium coverage by about 7 percent. The actual dollar equivalent ranges depending on the plan, but it can run as high as an extra $230 a year.

Then there’s Kentucky. According to the Kentucky Center for Economic Policy, there were particularly large shifts from the state to its employees between 2008 and 2011, when Kentucky increased the required contribution by some 55 percent. Subsequently, the state implemented major increases in deductibles, further increasing employee out-of-pocket costs.

It’s worth pointing out that there’s a great deal of variation in this field. “States have been wildly different in their approach to how much employees pay,” says Richard Cauchi, program director of health for the National Conference of State Legislatures. “Some states have had a tradition for many decades of paying as close to 100 percent of the cost as is feasible. And other states have straightforwardly said it’s an expectation that an employee will pay a substantial amount.”

New York City falls far at the generous end of the spectrum in its health care benefits. The largest city in the country has historically not asked employees for any contributions to health care premiums. One reason for this, says Carol Kellerman, president of the Citizen’s Budget Commission, is that “the public employee labor unions are very powerful in New York City and they are very influential. They’ve made this an extremely important item.”

Other highly unionized cities and states haven’t been as successful. But according to Steven Kreisberg, director of research and collective bargaining for the American Federation of State County and Municipal Employees: "If workers continue to have the freedom to use collective bargaining [for health care benefits], they’re able to protect” those benefits.

Even when employees’ share of their health care premiums haven’t risen by a large percentage, the impact on their out-of-pocket costs can be dramatic. A periodic 1 or 2 percent increase adds up to a tidy sum over time. To make matters worse from the point of view of the employees, even if their required contributions hadn’t increased at all, the ballooning cost of health care in general has made it harder and harder to pay.

Milliman, which is among the world's largest providers of actuarial and related products and services, assembled data for Governing by studying state employee health plans for 30 states. It found that the overall insurance premium growth increases in some states were dramatic, even in just the one-year time frame from 2016 to 2017.

West Virginia, for example, saw its total premiums rise by 15 percent in 2017. Ohio experienced a 13 percent increase; Idaho, 12 percent; Iowa, 10 percent; and Oklahoma and Washington each saw premium costs increase by 8 percent.

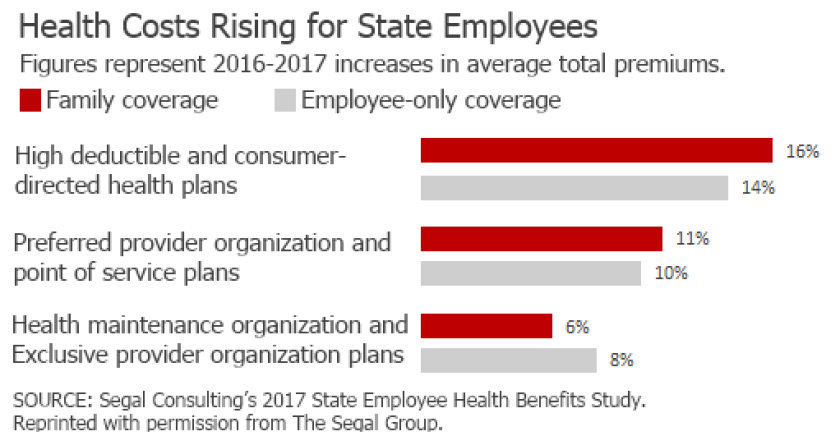

The increases in premiums tend to be far higher for family plans than for individual plans, says Richard Ward, senior vice president of the national public sector health practice for Segal Consulting. “They’ve been increasing the cost to families, not individuals, based on policy decisions that consider the obligation to the employee as opposed to the employee’s family.” In other words, states don’t feel like they owe as much to an employee’s spouse and children.

Some states and cities are attempting to keep their health-care costs down by instituting wellness programs, such as smoking cessation efforts. But it’s unclear how much benefit these programs will have, particularly in the near term. “Those things have had varying degrees of success,” says Neil Reichenberg, executive director of the International Public Management Association for Human Resources. “But every year the costs go up. So at the end of the day for state and local governments, it filters down to the budgets. And that means looking at how they can shift costs,” whether to employees or elsewhere.

This story has been updated. A previous version misleadingly characterized the scale of changes in New Jersey's premiums.