Although the Federal Reserve’s “tightening” actions have pushed money market rates higher, short-term municipal bond and note yields — returns to investors — still remain far below prevailing inflation rates. Yet tax-exempt munis with maturities over five years continue to yield more than taxable Treasury bonds and the market’s expected rates of future inflation, making their after-tax returns to investors — and their inflation-adjusted costs to borrowers — higher than public-finance textbooks would predict. It’s a two-faced market in muni-land.

Clearly, the muni market faces an unstable period for the next 12 to 24 months, first as Fed tightening continues, then while inflation rates hopefully subside, and then as the U.S. economy teeters between a soft landing and a recession scenariothat could compel another round of lower interest rates. Once again, debt managers and financial advisers face novel market and economic uncertainty as they map out their plans for capital projects, cash-flow borrowing and long-term debt management.

With Fed rate hikes expected to continue in coming months, what’s the strategic outlook for issuers of short- and long-term municipal debt?

The answer set is multiple choice, along these lines: (a) Short-term muni rates should remain well below the prevailing inflation rate, so tax-exempt cash managers will still enjoy negative “real” interest rates and thus a potential advantage over inflation. For some states and local governments, “borrow and buy” and “borrow and build” remain viable strategies relative to persistent inflation. (b) Long-term muni yields are still well below their average of the past two decades; the 2020-2021 pandemic-era trough in rates was an aberration unlikely to return. (c) Tax-exempt yields are now becoming attractive for longer-term investors, especially those in high tax brackets. (d) Muni bond issuers must still pay a premium over U.S. Treasury bond rates for debt maturing in 10 years or longer. That means their interest costs will likely exceed inflation over the longer term. (e) The municipal yield curve, depicting interest rates over a range of maturities, is much steeper than the Treasury market’s, with new and interesting implications for “refunding” bonds to reduce issuers’ costs. (f) Prospects of the muni yield curve eventually inverting — when short-term interest rates exceed long-term rates, seen as a harbinger of economic strife — remain quite low, as usual. (g) Short-term budgetary muni arbitrage remains alive and well for higher-quality issuers who can still reinvest tax and revenue anticipation notes at a profit without forking it over to Uncle Sam.

As you may have guessed, the best answer is “(h) All of the above.” Read on for reasons, rationale and some potential strategies.

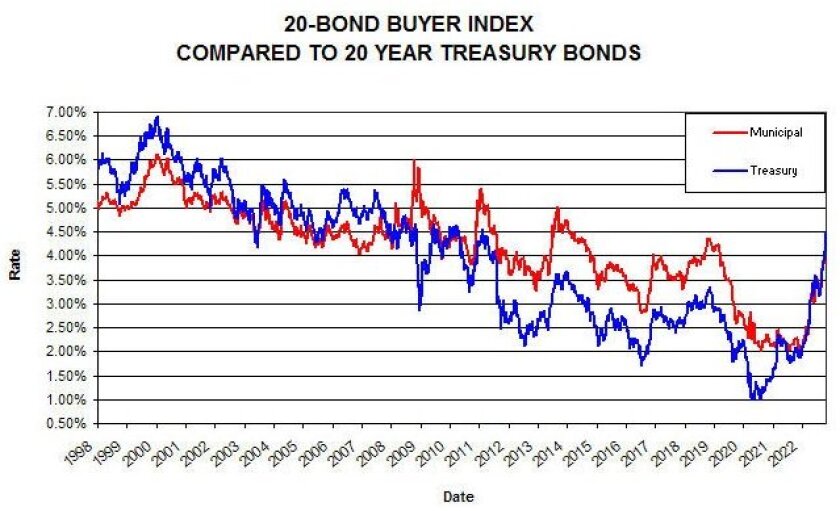

The chart below, which depicts the yields on U.S. Treasury bonds and an index portfolio of high-quality muni bonds, and how the current spikes compare to historical rates, helps explain several of these points.

Outracing Inflation

Banks and money market mutual funds have a voracious appetite for short-term tax-exempt paper. As a result, today’s strong demand for that paper results in muni yields below the inflation rate, likely to continue for at least a year or two. For longer-term muni yields, however, the opposite is true, as long-term munis carry higher interest rates than taxable Treasury bonds, which trade at levels at or above the inflation rates that investors expect to prevail over 10, 20 and 30 years.

This anomaly gives short-term municipal borrowers an opportunity to outrace inflation, if they plan to later fund construction projects permanently with long-term bonds. They can even invest the proceeds of short-term debt in taxable securities for a profit in many cases, if the construction period and spending plan meet IRS rules. In states where bond anticipation notes are customary, this strategy allows construction projects to proceed with cheap money now bearing interest rates lower than probable cost increases, and then sell their long-term permanent financing in a few years, when both economists and the market expect inflation to be lower.

There is no guarantee, but that’s a possible “cake and eat it too” scenario, especially if the Fed does squeeze inflation out of the economy by 2024. Whether the subsequent total cost of such debt management is actually lower than selling long-term now is a subject that requires deal-specific analysis — and of course nobody can predict what markets and the CPI will actually look like in a year or two.

Opportunities for Arbitrage

With this disparity between tax-exempt and taxable yields in the short-term markets, there is still a viable opportunity for many public issuers to continue to benefit from budget-cycle cash-flow arbitrage. That’s where a tax-exempt entity borrows money within its fiscal year to cover its deepest cash-flow deficit and invests it profitably in taxable money market securities, typically U.S. Treasury bills and notes. The traditional muni debt instruments are tax and revenue anticipation notes, known collectively as TRANS in the trade. They are both perfectly legal when issued within IRS regulatory requirements and continue to be modest money-makers for jurisdictions that have the specified revenue-expense structure and tax-collection cycles that qualify under those IRS regs.

There are other cost-cutting opportunities for issuers. Most muni bonds have historically included a 10-year call feature, which gives the issuer an option to redeem high-coupon bonds and then re-issue new, lower-rate refunding bonds. Today’s still historically low muni interest rates allow some issuers to redeem older bonds and replace that expensive debt with new paper at today’s lower rates. Although many exploited that strategy earlier in the pandemic era — a refunding bonanza back then — there is still a smattering of outstanding bonds with 5 percent coupons whose call dates have just arrived, presenting another savings opportunity.

Going forward, issuers may anticipate that in coming years inflation and interest rates will be lower as the end product of the current Fed tightening. If today’s exaggerated yield relationships do normalize to the advantage of those who issue today with a shorter call date — maybe five years hence instead of 10 — then a future refunding strategy could cut costs over decades. Whether a deal team can secure financing on those more-generous terms without having to accept an even-higher interest rate today will ultimately depend on local factors and investor appetites. Historically, the call feature has been a cheap option in the muni market, so it’s possibly worth pushing the edge of the envelope.

The other alternative for today’s issuers would be a fixed-to-floating design in which new bonds convert to variable-rate debt pegged to shorter-term yields after five years. That’s a structure commonly used in the corporate market for preferred stock dividends, and may have potential for munis in the coming year. The floating-rate feature is attractive to investors averse to duration risk, the sensitivity of a bond's price to interest rates changes. If the CPI and interest rates do normalize in a few years, this might be the best of both worlds: lower short-term muni rates today coupled with lower future rates.

Pension Implications

Stocks are not cheap enough, nor muni yields low enough, to make a pension obligation bond attractive strategically right now. Even though stock indexes are down 20 percent or more of late, the outlook for traditionally implemented POBs is impaired now because of today’s unfavorable bond market structure. If a higher-cost POB (which is taxable) is issued today and invested in a traditional mix of pension assets, the odds of a profit from the pension portfolio’s bond positions are unattractive.

So the only strategy that works in today’s market would be to sell a downsized batch of taxable muni pension bonds only if stocks get considerably cheaper and then invest the proceeds entirely in a stock index portfolio. Then, if inflation ultimately normalizes lower, as many expect, it should be possible to call and refinance 2022-vintage pension bonds at lower rates. This requires savvy design with a call feature as early as feasible. But it’s not the kind of complex and novel strategy that most financial advisers and underwriters who pitch pension bonds want to mess with, because it’s outside their strategic paradigm and messaging toolbox.

For most pension systems, the safer strategy would be to just wait a year or two for the next recession, which more economists expect, when stock prices and bond yields are both lower. In the meantime, this is an excellent time to “set the table” by seeking the requisite approvals to issue when the time is right. POB windows rarely last very long. Of course, this strategy fails if the Fed achieves a soft landing and stocks run away to the upside — but of course that would be to the relief of public pension managers and trustees.

The bottom line: Today’s muni market yield configurations are likely to be “normal” in one way, but transitional in another. Expect more adjustments if and when inflation rates ultimately subside and drift significantly lower toward the Fed’s 2 percent long-term target. The challenge for tax-exempt borrowers today evokes the hockey puck cliché — in this case, how to play to where the market is headed, not where it is right now.

Governing's opinion columns reflect the views of their authors and not necessarily those of Governing's editors or management. Nothing herein should be considered investment or issuance financial advice.

Related Content