But while state and local treasurers enjoy these calmer seas, they also have an opportunity to prepare for stormier weather by doing what they can to better protect their checking accounts and the CDs they buy. They can work on a constituent-friendly legislative agenda by pressing Congress for expanded federal insurance for the public deposits they park with their local banks.

The highest overnight rates in 20 years are certainly welcome at a time of weakening tax revenues and drying-up federal COVID-19 relief. After many years in a professional desert, with the interest on short-term paper yielding almost nothing, cash managers have been reinvigorated by the recent run-up in rates engineered by the Fed. Whether it's internal staff or an outsourced portfolio manager, the higher yields on working capital now available make it worthwhile to pay closer attention to the short-term rate markets.

Outsourced money managers are no longer waiving fees, as many had to do when yields were near zero, and underperforming portfolios are mostly back to par, so the hired guns are now very happy campers. For internal staff, the 2024 market has kept rates high enough to offset many of the clunky, low-yielding longer maturities they naively bought before the Fed began to tighten.

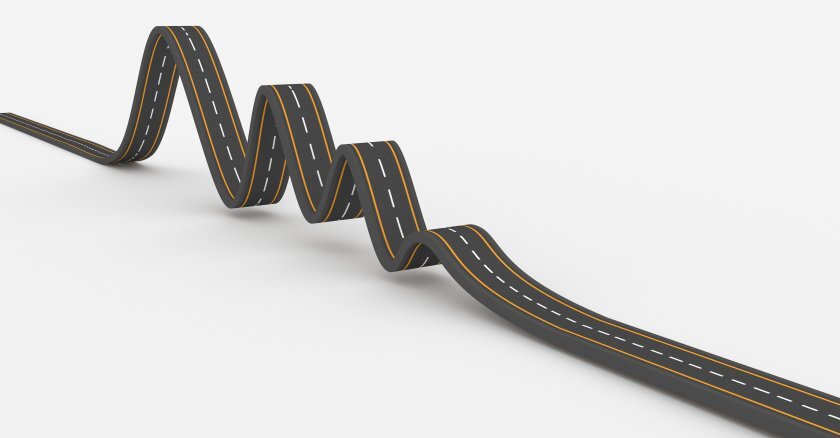

Today, state and local cash managers face a unique situation of being able to snag the highest yields from lower-risk short-term investments. Because the yield curve is inverted, with lower rates on longer maturities, there is no time premium on money to reward investors for tying up their funds beyond 2024. So before they extend maturities, most will sit contentedly on short paper until they see short-term rates starting to drop.

As for interest rates, I continue to believe that an inverted yield curve is not a sustainable market structure and that eventually the Fed’s slightly restrictive monetary policies will succeed in braking the economy to a slower pace that allows inflation to continue to drift lower. Whereas I had thought that result would mostly be accomplished in the second half of this year, the economy keeps showing enough vigor — and inflation enough stickiness — that it may take somewhat longer than that.

So by spring in 2025, it still seems likely that the overnight interest rates, three-month Treasury bills and money market mutual funds will be carrying yield “handles” of 4, not 5, percent. Such an eventual shift to somewhat lower but still “snug” short rates would make today’s two-year Treasury notes, yielding near 5 percent, look like a reasonable hedge against a Labor Day 2025 rate environment closer to 4 percent. That’s a conceivable outcome worth at least considering strategically.

Extending portfolio maturities against a downward-sloping, inverted yield curve is never a comfortable undertaking, especially when some professionals are predicting yet-higher bond yields.The easy choice is to stay short and just follow the market: Nobody ever got fired for taking that approach.

But budget officers may have a different point of view if rates do eventually drift lower in 2025 and they suddenly find themselves coming up short on their projected interest-income revenues. That makes it worth having a family discussion about longer-maturity rate locks at the internal staff level, and in some cases a strategy briefing with oversight officials, so that the cash managers don’t get second-guessed next year.

In that environment, the interest rate differential between U.S. Treasury obligations and bank CDs, commercial paper and federal agency paper gets wider, in favor of less-marketable instruments for longer maturities. In the case of most local bank CDs, their secondary marketability is limited or even nonexistent, as is the case with many commercial paper issuers, so those investments are locked up until maturity for all practical purposes.

In the case of negotiable CDs and U.S. agency paper such as Federal Home Loan securities, the problem is their call feature, which means the issuer can redeem at par and will likely do so if rates decline, so there is very little lock-up benefit on many of those instruments. Always remember the market adage that it’s unwise to pick up nickels in front of a steamroller, and that “liquidity comes before yield” in most investment policies.

FDIC Enhancement for Public Deposits

While on the topic of public cash management, a timely article was published recently by the Public Funds Investment Institute that makes a case for raising Federal Deposit Insurance Corporation (FDIC) limits for public deposits. The argument is that current FDIC limits were fixed by Congress in 2008 and inflation alone has eroded 45 percent of their value. Another angle is that raising the deposit insurance limits could reduce the local bank obligations to collateralize public deposits that are required in many states, which would make more bank capital available for community lending.

For municipalities and other local agencies, there could be a narrow expansion of coverage to provide FDIC insurance limits for only public deposits of $1 million for each physical loan-making bank branch office located in the geographical boundaries of the municipality or agency, with a $5 million maximum per bank for each jurisdiction. So a school district with three branch offices in its boundaries would thus qualify for $3 million of FDIC insurance. An urban county with dozens of branch offices would max out at $5 million of deposit insurance for each bank with five or more qualifying branches. For states, the limit could simply be $5 million per bank for all state accounts collectively.

To facilitate accurate, expedited FDIC resolution in the event of a bank failure, each political subdivision should be required to annually register the number and locations of qualifying branches in its territory with a designated state agency. For municipalities and schools in particular, this arrangement would help support local consumer and small-business lending while increasing the odds that the public cash manager actually knows the bank and has verified its qualifications. A similar protective regime for jumbo public deposits at credit unions could be legislated for their separate insurance program.

At the risk of over-complicating a lobbying proposal, treasurers with a progressive constituent mindset could even push this concept a step further with an additional bonus FDIC allowance of $2 million per branch that serves a lower-income census tract if it meets stringent capital ratio requirements. Such a provision would get the attention of bank managers and community lending advocates. Adding this feature would almost guarantee support from populist politicians, without drawing the ire of conservatives as long as that capital ratio hurdle is embedded.

So public cash managers have some important work to do this year. Unless inflation somehow magically disappears, it seems unlikely that the U.S. money market will return to the near-zero interest rate regime of the past decade, so cash management is once again a professional function of state and local governments that merits closer attention.

This year, the primary focus will be navigating the yield curve, but the public finance and banking professional associations should not overlook the value of also securing expanded governmental FDIC insurance limits that would support local lending.

Governing's opinion columns reflect the views of their authors and not necessarily those of Governing's editors or management. Nothing herein should be construed as investment advice.