Markets now face a world of positive “real” interest rates — rates that exceed inflation — and there’s new talk about the “term premium,” which is the extra interest that longer-term investors now demand for the risks they take of higher future rates, along with growing federal deficits and possible higher inflation. Gone are all the pro-deficit incantations of a few years ago about the supposedly supernatural powers of Modern Monetary Theory to keep interest rates low forever while political vampires gorge on government debt.

When the Fitch investors’ rating service downgraded the credit of U.S. Treasury bonds on Aug. 1, that was the final straw. That was when the municipal bond market then saw the most rapid run-up in its yield curve in memory. I wrote not long ago that states and localities with AAA ratings could still outrun inflation by borrowing at favorable tax-exempt interest rates, but that window has slammed shut.

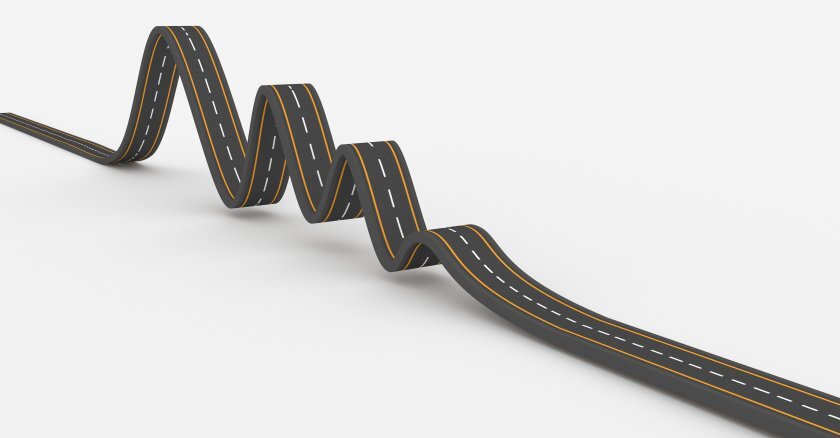

Meanwhile, inflation has been persistently above the level that the Federal Reserve wants, and recent double-digit “catch-up” labor union wage demands have sent a chill through the financial world that inflation may be stickier than previously thought, even if progress toward stable prices with full employment continues on other fronts. There’s more talk nowadays about shifting from an overstimulated economy to a “soft landing” without a recession, but it’s likely to be a tricky descent because of the fragility of the economy given global geopolitical risks and regional bank balance sheet hangovers.

So state and local officials face a 2024 scenario of 3 percent inflation and 5 percent municipal bonds, at least for those issued with maturities beyond 10 years and credit ratings below AAA. My advice for now is pretty simple: Get used to it, at least for a year or two. The federal deficit is not going away, the U.S. budget won’t magically get balanced and the Federal Reserve is unlikely to stop trimming its massive bond portfolio anytime soon. So higher bond yields will keep pressuring the muni market throughout 2024 and arguably beyond. Full employment (by historical standards) can persist, but at the price of elevated interest rates. If Congress ever gets its act together to attack endless federal deficits, it’s possible that frightfully high interest rates will subside, but for now that’s not a popular bet in financial circles.

On the inflation front, the Fed is clearly striving for a 4 percent ceiling for now, while aiming for less, and despite wage escalation from the recent strike activity in some industries it’s unlikely that national CPI data will turn too far upward. But it’s also highly improbable that inflation will slither down to the Fed’s announced goal of 2 percent anytime soon. This bumpy budgetary disinflation leaves states and localities somewhere in the middle — in a place that’s tricky but manageable for most. Here’s the outlook for how they will muddle through:

Tax Revenue Nuances

For state and local budget officers, especially those with constrictive constitutional or legislative tax-rate limitations, the revenue pressure points are nuanced. Income tax revenues, other than those flowing from capital gains, should hold up pretty well and in line with the overall national inflation rate. Likewise, sales taxes should hold up as long as most consumers remain employed and the banking system keeps its head above water. Miscellaneous taxes on hospitality, utilities and emerging businesses such as the cannabis trade should also keep pace with the economy and not just inflation. So revenues should be there to cover most public-sector costs in a world of 3 percent inflation.

The one black cat to beware is the potential for a plateau in residential property tax revenues if mortgage rates persist at current levels near 8 percent, or creep higher. The economics of homeownership at today’s real estate prices just can’t add up in the face of monthly mortgage costs that have doubled in just two years. Local governments and school districts heavily dependent on property taxes may find it difficult or impossible to cover even 3 percent inflation of their expenses in coming years if they have already aggressively maximized their assessment levels leaving no margin for volatility.

Local officials cannot ignore what economists call a “non-zero risk” that persistently high mortgage rates could eventually crumble the property tax base. Most assessors lag the actual market, so it takes time for a decline in property values to hit the local tax base, but a scenario is conceivable where valuations have been pushed to an unsustainable level and residential property prices slide downward simply because of financing costs. Absent a national recession, however, such an outcome should be spotty and mostly limited to isolated jurisdictions.

Compensation Catch-Up

When it comes to salaries, public employers with diversified revenue sources should be able to muddle through as long as their collective-bargaining counterparts get the point that post-COVID inflation has already outrun everybody and there won’t be any money growing on trees to make workers whole for what they’ve previously lost to the CPI.

But therein lies the rub: The problem for public employers (and counterpart union officials) is “catch-up.” Recent inflation rates are not the problem — it’s the CPI increases of 2021-22 that bled out public employees’ household budgets and haunt today’s collective-bargaining sessions. Political pollsters know that the national mood remains gloomy about the economy while workers know that their spending power has shrunk, especially at the meat counter and the gas pump, and no amount of politicians’ rhetoric about full employment and “inflation reduction” will make up for that. With a tight labor market making it hard to retain and hire employees, many public employee unions have strong bargaining power to push hard for “make-whole” pay raises. Compared with the private-sector unions whose compensation demands are in the news today, it’s setting up a delayed reaction in the public sector that won’t hit many budgets until 2024.

Where labor has clout, this implies an increase in payroll costs, which are then coupled with higher health insurance premiums to produce an overall expenditure rate that outstrips the growth in tax revenues. If salaries only grow at 3 percent, most jurisdictions can likely squeak through, but in many cases that’s simply not a realistic real-world outcome. Finance officers will be asked repeatedly to “go find more money,” as if there were free trick-or-treat candies awaiting them somewhere cloaked in the books to balance next year’s budgets. In many cases, that will require digging into reserves and short-changing rainy-day funds in the hope that the economy’s soft landing has a long runway without potholes. That raises a cynical question as to whether the recent professional chatter about “rethinking reserves” is an academic cover-up for moving public employers onto treacherous ground at a fragile point in time. Just remember that one can only spend one’s reserves once.

Rethinking Pension Investments

Three percent is also a magic number for pension funds, as it’s close to the actuarial rate of inflation assumed by many, although a number of systems went lower before the COVID-19 years, thinking wishfully that disinflationary forces would last forever. Although most pension funds fell short of their actuarial rate of return on investments in the last year, their forthcoming payroll contribution rates are still unlikely to be materially higher in the near term. For most employers, pension costs in the next year or two should generally reflect the salary inflation rate and not much more. Retiree health-care expenses, however, will reflect the national average of 6.5 percent premium inflation, well above the revenue increases of most employers. Those with unfunded promises for retiree health insurance will continue to dig themselves a deeper grave, fiscally.

Within the public pension portfolios, this new era of “higher for longer” interest rates should be driving staffs, consultants and trustees to reconsider their love affairs with alternative investments, particularly the high-fee hedge funds and other purveyors of “synthetic income” that flourished in the past decade. Why should pension funds now pay blood-sucking management fees plus carried interest to hedge funds whose long-short positions and high-frequency trading algorithms too often provide meager returns net of fees? Investment-grade bond portfolios can now produce equivalent and more-consistent net returns for a decade or longer than many of the overhyped hedge fund strategies. Pension trustees and senior staffers should be putting this issue on their agendas and grilling their consultants. If anything in public finance now needs “rethinking,” it’s the wasteful allocation of pension capital into high-fee hedge funds.

Muni Bonds and ‘Real’ Costs

For issuers of tax-exempt bonds and their underwriters, the recent run-up in market yields to 14-year highs has spooked both the buyers and sellers of muni debt. Until investors can regain confidence that inflation and Treasury bond yields are under control, it’s hard to expect a return to dreamy 3 percent interest rates on longer-term debt for states and localities. Were it not for the tax exemption, the muni market would be feeling some real pain in sync with the corporate bond world. But the precious structural yield discount given by Congress to states and their subdivisions through federal income tax exemptions will continue to make such borrowing a viable way to fund capital projects.

Obviously a dollar of annual debt service now buys less in immediate capital improvements, but relative to inflation, local taxpayers should not suffer too badly over time. Put another way, the “real” cost of capital expenditures by states and localities will continue to be quite modest, compared to the rest of the economy. Worthwhile, necessary and productive infrastructure continues to be a good investment for taxpayers. Although a case could be made that lower borrowing rates will await those who can hold off until the next recession, such acumen in cyclical market timing eludes the mindsets of most elected officials and voters, and meanwhile construction costs keep escalating, so project deferral is not rewarded by today’s economics of public finance.

Consequently, most muni bond issuers are remarkably indifferent to interest rate fluctuations in this range. They focus more on principal and annual payment schedule designs than on market timing. Many of them must secure voter or legislative approval for issuance of principal, but not for payments of interest; municipal utilities usually have authority to adjust user fees to cover higher interest costs. So unlike corporate America, this year’s unprecedented run-up in muni bond yields is largely inconsequential for state and local officials’ infrastructure decision-making.

Where the real problem could lie ahead for the muni bond market is what happens after the next recession. If Congress cannot get its fiscal house in order and the escalating debt service burdens of the U.S. Treasury continue on their current trajectory, the outlook for muni bonds in the next decade becomes creepier. And then, it’s far more likely that the coveted tax exemption for “conduit” deals — municipal bonds sold to finance a private or not-for-profit project — would be in jeopardy, so today’s public finance community has its work cut out on Capitol Hill with each passing year. Always remember that the Supreme Court has held that tax exemption is a legislated public policy privilege, not a state's right.

Cash Managers in Superhero Costumes

For now, cash is king in the credit markets, meaning that short-term investors can earn a higher interest rate than prevailing inflation. So public cash managers will pretend to be superheroes as they head into 2024. At some point, the Federal Reserve is expected to discontinue its stairstep increases in short-term interest rates, but it’s clear that its board intends to hold those persistently above the inflation rate in order to eventually bring the CPI level closer to that 2 percent goal. That doesn’t look likely to happen any time soon, but there will come a point at which money managers, if they finally see inflation rates shriveling, will shift their strategies to longer-term paper. In fact, the money market mutual fund industry and some of the local government investment pools’ portfolio managers are starting to tippy-toe in that direction.

However, having been burned by longer “intermediate” maturities two years ago when they sent taxpayers’ cash to the money market graveyard, most public-sector treasurers will likely avoid going too far out on a limb on the yield curve, at least for now. This pack tends to move as a herd, instinctively buying the highest yields they can find; a shift into longer maturities at lower rates is counterintuitive to most of them. As some would say, nobody rings a bell when it’s time to lock in yields.

So despite televised market chatter and mounting political rhetoric about the economy, federal debt and inflation, the inside story for state and local officials is that for most of them, that’s all going to be noise and they will once again be able to muddle through — just the way the phrase was intended when published in the annals of public administration 64 years ago. Like haunted house patrons, they’ll ultimately survive the scares and find their way out.

Governing's opinion columns reflect the views of their authors and not necessarily those of Governing's editors or management. Nothing herein should be construed as investment advice.

Related Articles