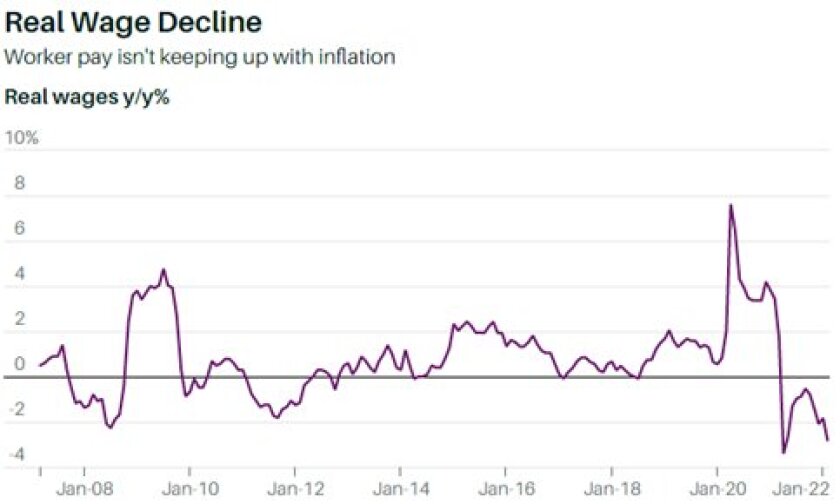

How soon and how much those will have an impact is anybody’s guess. But right now, workers everywhere are expecting or even demanding higher pay to compensate for higher prices and housing costs, and the labor markets are tight enough that employers have little choice but to accommodate them in one way or another. Public-sector labor negotiators and budget officers must face the reality that labor representatives cannot come to the bargaining table asking for less than a catch-up adjustment for the inflation that has already hit their membership. In many cases, their workers now are paying more for goods and services than their pay increased last year. The chart below vividly highlights the problem of recently declining real wages — wages whose buying power is adjusted for inflation:

So there is no realistic reason to expect that represented employees will settle for a compensation package that has already been eroded by inflation and will be worsened further this year. Management teams must make it clear to their policymaking boards that we’re not living in the high-inflation world of the 1970s, when there was no shortage of qualified workers for government jobs, nor the Great Recession, when revenues cratered. But at the same time they must avoid giving away anticipatory future increases that could result in overcompensation if inflation begins to settle down sometime in 2023.

For employers seeking to negotiate a multi-year labor agreement that will extend beyond 2022, the big problem now is how to structure future CPI and cost of living adjustments. Inflation won’t drop to zero next year, or even recede to the 2 percent annual rate that the Federal Reserve seeks to eventually achieve as it tries to put the inflation genie back into the bottle. But it is likely to decelerate by mid-2023, hopefully on a two-year glidepath to low single digits. Nonetheless, employer representatives bargaining over future salary increase formulas must recognize that because in 2021 most public employees’ pay did not keep up with inflation, they are now playing catchup baseball.

But to extrapolate today’s 7-10 percent headline inflation rates into 2023-24 pay hikes is probably an unwise overshoot, if not structured and calibrated properly. Nobody drives a car by gazing only in the rear-view mirror and never tapping the brakes. Today’s labor-cost acceleration is likely to slow down next year even if the economy continues to expand.

The ’COLA Bonus‘ Fallacy

One tactic that was used by some employers in the past, going back to the 1970s, was to separately formulate inflation compensation as a bonus or special-pay item, on the theory that it won’t become embedded in base pay and salaries that cannot be reversed. My professional experience from that era, however, was that eventually most of those non-recurring payouts did get folded into base pay, and the cosmetic efforts to isolate them proved futile.

Economists say that inflation and wages are both “sticky” — resistant to changing as quickly as market conditions — and that they always ratchet upward, never to return below the starting point. Next year, we will likely see “disinflation” — successively lower inflation rates — but we rarely encounter actual “deflation,” a reduction in overall price and wage levels. So those who pitch the “COLA bonus” policy strategy should understand that they are really only kidding themselves. Although this wordage makes it easier to convince frugal foot-draggers who think they can avoid the inevitable, it’s really just that — either a pretext, political posturing or magical thinking.

An exception might be employers whose revenues are capped, such as they are for California municipalities that are subject to Proposition 13 tax limitations and highly dependent on the property tax. There, a formula could provide for salary increases to be limited to the total increase in employers’ revenues if those keep running at a lower rate than the CPI itself. In such a case, a supplemental “unfunded COLA stipend” for inflation payouts above the employer’s revenue growth rate could be provided and subject to a future employee vote to discontinue them in lieu of foreseeable layoffs if the jurisdiction’s salary-revenue gap widens or a recession sinks in.

Avoiding Cherry-Picked Data

One suggestion for parties engaged in disputes over CPI mathematics is that they should agree upon a shared exhibit of the CPI index showing each month’s annualized rate of increase and the backward-looking 12-month price change. Graphing out the contract periods and last-pay-raise dates with these points of reference will reduce the tendency of contentious parties to cherry-pick data to suit their argument. Fortunately, the Government Finance Officers Association is setting up a useful new web page with these data and tools, which should be available for the public finance community very soon.

In some cases, it will be impossible to agree on multiyear contracts if adversarial expectations about the next two years are irreconcilable. In that case, a short-term agreement may be unavoidable, with the understanding that next year it’s a new ballgame. Employers seeking labor peace, or at least predictability, will probably have to pay an inflation premium. To appease tightwad policymakers who perennially pinch payroll pennies, a rollback clause may be the only way to mollify them, even if it’s just cosmetic.

Of course, nobody today can predict what will happen to consumer prices in 2023, especially if the Ukraine hostilities and Russian sanctions worsen rather than improve. Even if global normalcy returns by year end and the Fed keeps raising interest rates to the wishfully modest levels that markets still expect, a 4 to 5 percent CPI rate for calendar 2023 seems plausible, with more risk above that range than below it. The latest financial market-based projection is 5.6 percent.

So inflation will be the wild-card issue in public-sector labor relations this year, and it’s now time for management, financial staff and policymakers to realize the limits on their ability to control pay rates until we achieve both domestic and international stability. Explaining it to voters will likely be the greater challenge.

Governing’s opinion columns reflect the views of their authors and not necessarily those of Governing’s editors or management.